Corporate insiders own 9.12% of the company’s stock. Insiders have sold a total of 14,003 shares of company stock worth $71,714 in the last quarter. The sale was disclosed in a filing with the SEC, which is available at this link. Following the completion of the sale, the director now directly owns 19,872 shares in the company, valued at $127,180.80. The stock was sold at an average price of $6.40, for a total value of $39,360.00. Troe sold 6,150 shares of the business’s stock in a transaction that occurred on Friday, June 16th. Shares buyback programs are usually a sign that the company’s leadership believes its stock is undervalued. This buyback authorization permits the company to buy up to 81.1% of its shares through open market purchases. Stem announced that its board has authorized a stock buyback program on Wednesday, May 3rd that permits the company to buyback $500.00 million in shares.

will post -0.64 EPS for the current year. The company’s revenue was up 63.4% on a year-over-year basis. During the same quarter last year, the company posted ($0.21) earnings per share. The business had revenue of $67.00 million during the quarter, compared to analyst estimates of $63.34 million. Stem had a negative net margin of 37.59% and a negative return on equity of 26.02%. The company reported ($0.29) EPS for the quarter, missing the consensus estimate of ($0.24) by ($0.05).

#Stem holdings stock price free

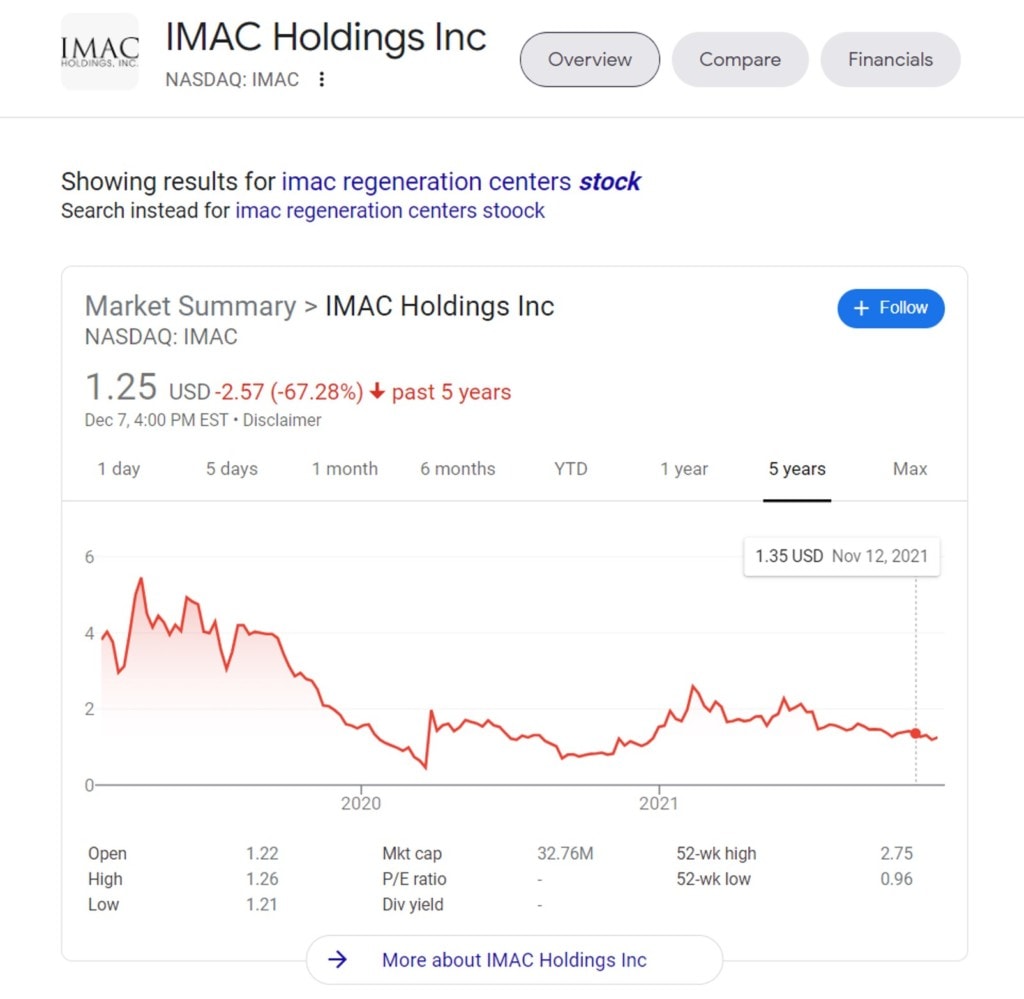

Stem ( NYSE:STEM – Free Report) last released its quarterly earnings results on Thursday, May 4th. The company has a market capitalization of $940.96 million, a PE ratio of -6.37 and a beta of 1.97. has a 1 year low of $3.71 and a 1 year high of $18.02. The business has a fifty day simple moving average of $5.15 and a 200 day simple moving average of $6.82. The company has a debt-to-equity ratio of 0.87, a current ratio of 1.85 and a quick ratio of 1.70. Based on data from, Stem presently has a consensus rating of “Moderate Buy” and a consensus price target of $11.97. One equities research analyst has rated the stock with a sell rating, four have assigned a hold rating and eleven have assigned a buy rating to the company’s stock. Finally, Wolfe Research cut shares of Stem from an “outperform” rating to a “peer perform” rating in a research note on Thursday, April 6th. The Goldman Sachs Group lowered their price target on Stem from $14.00 to $12.00 and set a “buy” rating on the stock in a research report on Thursday, March 30th. UBS Group reduced their price target on Stem from $9.50 to $8.00 in a research report on Tuesday, May 9th. Bank of America downgraded Stem from a “neutral” rating to an “underperform” rating and lowered their target price for the company from $9.00 to $5.00 in a research report on Tuesday, April 4th. They set an “outperform” rating and a $11.00 target price for the company. Evercore ISI initiated coverage on shares of Stem in a report on Tuesday, May 23rd. Several brokerages recently commented on STEM. Institutional investors and hedge funds own 60.84% of the company’s stock. Finally, Ensign Peak Advisors Inc bought a new stake in Stem in the 3rd quarter valued at approximately $113,000. Zurcher Kantonalbank Zurich Cantonalbank acquired a new stake in Stem in the 2nd quarter valued at approximately $53,000. Point72 Hong Kong Ltd bought a new position in shares of Stem during the first quarter worth about $67,000. Capital Wealth Advisors LLC acquired a new position in shares of Stem during the fourth quarter worth about $35,000. SailingStone Capital Partners LLC bought a new stake in Stem in the 4th quarter valued at $34,000. Several other institutional investors and hedge funds also recently made changes to their positions in STEM. Allspring Global Investments Holdings LLC’s holdings in Stem were worth $1,223,000 at the end of the most recent reporting period. The institutional investor owned 215,722 shares of the company’s stock after selling 169,612 shares during the quarter.

( NYSE:STEM – Free Report) by 44.0% during the first quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. Allspring Global Investments Holdings LLC trimmed its position in shares of Stem, Inc.

0 kommentar(er)

0 kommentar(er)